When issues arise with your insurance provider, it can be a frustrating experience. Fortunately, there are steps you can implement to effectively navigate these disputes and reach a favorable outcome. First, thoroughly review your insurance policy to clarify the terms and provisions. Document all communication with your insurance company, including dates, times, and details of the discussion.

- Make to resolve the dispute amicably by contacting your insurance agent directly.

- Clearly explain your concerns in writing, providing relevant documentation.

- Should the dispute remains unresolved, consider submitting a formal complaint to your insurance company's grievance office.

Consider alternative dispute resolution methods, such as mediation, to obtain a fair agreement. website Keep in mind that you have the right to consult an insurance attorney if needed.

Resolving Insurance Disputes: Strategies for Success

When you find yourself challenged with an insurance dispute,it can feel overwhelming. The process of seeking compensation {can be complex and time-consuming|, and knowing where to begin presents a challenge.

However, by employing effective strategies, you can increase your chances of winning your claim. First, it's crucial to thoroughly review your policy documents.

Familiarize yourself with the terms and conditions, particularly those relating to your specific circumstances. Next, gather all relevant proof, including photographs, receipts, police reports, and statements from witnesses.

This detailed documentation will strengthen your claim and demonstrate the validity of your stance.

Evaluate reaching out to an insurance advocate. These professionals have expertise in navigating insurance claims and can provide valuable advice throughout the process.

Remember that clear, concise, and respectful communication is key when dealing with your insurance copyright.

Navigating Insurance Claims: Tips for Avoid and Resolve Conflicts

Filing an insurance claim can often be a stressful process. However, by knowing your policy terms and accurately communicating with your insurer, you can smoothly navigate this process. One of the key approaches to avoid conflicts is thoroughly documenting all occurrences related to your claim.

Maintaining detailed records, including photos, videos, and witness accounts, can validate your claims. When interacting with your insurer, be specific about the details of your claim and reply to their inquiries promptly.

Keep in mind that open dialogue is essential for addressing any differences. If you encounter challenges with your claim, be willing to appeal the issue to a supervisor within your insurer's company.

Insurance Battles: Know Your Rights and Fight Back

Dealing with an insurance claim can often feel like navigating a labyrinth. Firms may disapprove your claim, leaving you feeling helpless and frustrated. But don't despair! Knowing your rights is the first step to winning a fair outcome.

- Scrutinize your policy carefully to understand its clauses. This will help you identify what coverage you have and what situations are covered.

- Document all relevant details thoroughly. This includes snapshots of the damage, medical records, police reports, and any other corroborating materials.

- Don't be afraid to negotiate with your insurer. Be polite but firm in presenting your case and demanding a fair settlement.

- Reach out to an insurance attorney if you feel stuck. A legal professional can provide valuable guidance and help you through the complexities of the process.

Be aware that you have rights as an insured individual. Don't let insurance conflicts control you. By being informed, you can fight back.

Beware of Insurance Schemes: Securing Your Financial Well-being|

The insurance industry can be complex language. This difficulty makes it consumers to properly grasp their policies and rights. Insurance companies frequently employ certain tactics that seem harmless but ultimately aim reducing their payouts. It's crucial to stay informed and implement strategies to ensure your rights.

- Understand common fraudulent practices

- Thoroughly review your insurance contract

- Ask questions

- Keep records

Navigating Insurance Disputes: The Power of Persistence

Persistence may be the key in successfully working through insurance disputes. These cases tend to escalate complex and tiresome. Insurers may present initial settlements that are unacceptable. However, with a determined approach, you can bargain a mutually agreeable outcome.

Stay Away From getting discouraged if your initial attempts turn out setbacks. Instead, keep striving to express your concerns clearly and present any compelling evidence. Consider engaging the services of an experienced insurance advocate who can guide you in the legal proceedings.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mackenzie Rosman Then & Now!

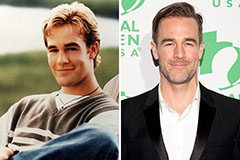

Mackenzie Rosman Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!